Onamba (5816.T) - Japanese Net-Net, PB<0.5, PE~6, 7.3% dividend yield

Onamba is one of the stocks in my “Japanese Deep-Value Basket.” My thesis is simple - Onamba represents a stable, overcapitalized, shareholder-friendly, high dividend yield stock that I can buy with borrowed yen from InteractiveBrokers with a ~1.5% interest rate.

A quick description:

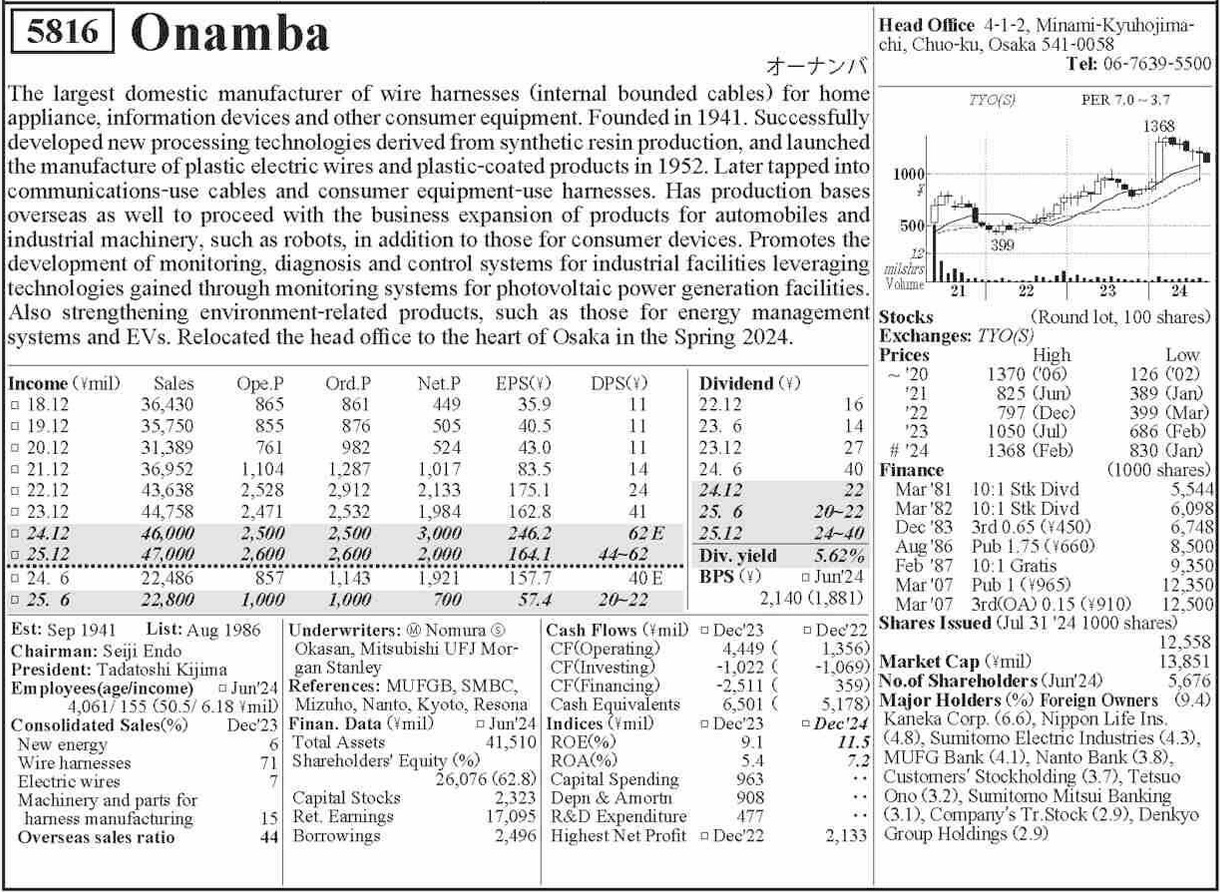

80+ years old, Low-moat electrical wire producer

Globally diversified - 44% of sales overseas

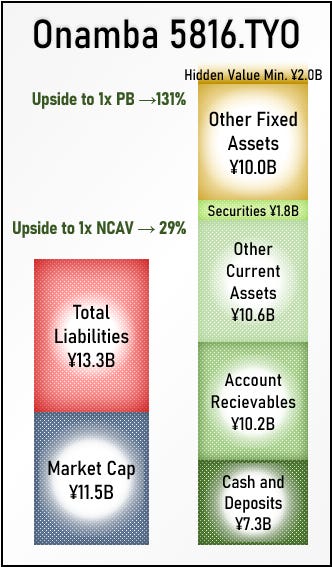

Trading at ¥948/share, Market Cap ~¥11.6B

Net-Net Valuation | P/NCAV 0.82x | PB 0.45 | Forward PE ~6

Slightly cyclical with Automotive & Industrials

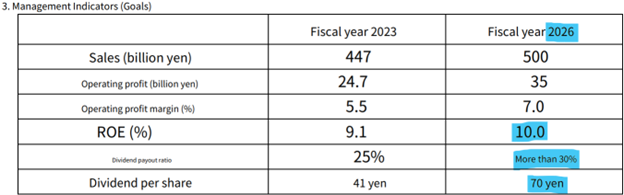

TSE reform answered with ROE goal of 10% | 30% Payout Ratio | Potential Buybacks | Potential Asset Sales (with special dividends)

Dividend per share 49¥ ~5.2% yield (+ 20¥ special ~7.3% yield)

I’m publishing at least one new Japanese deep-value pitch each week. A full comparison table is coming soon to help track valuations, catalysts, and progress. Subscribe to follow along.

Why Japanese Small Cap Stock?

“We don’t have an analytical advantage, we just look in the right place.” — Seth Klarman

In today’s hyper-analyzed global market, it’s hard to find true inefficiencies in the S&P 500—or even among U.S. small and micro-caps. But, in Japanese small caps, and especially among net-nets, pockets of opportunity still exist. Many companies trade far below liquidation value; some are profitable, shareholder-friendly, and off the radar. Onamba is one of them.

Business Summary

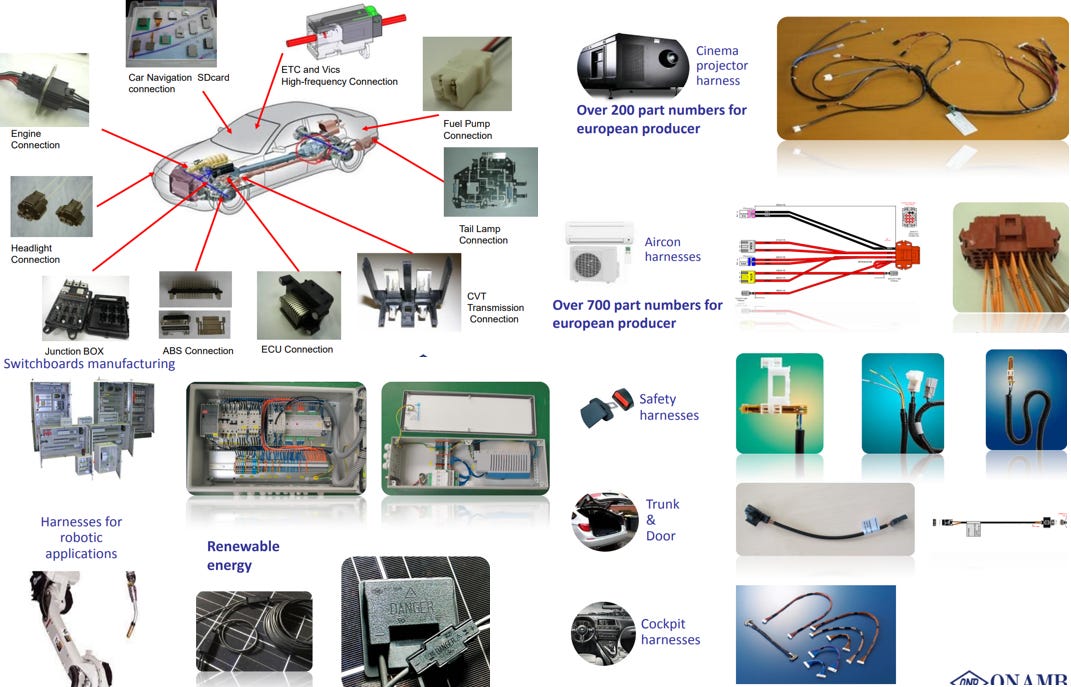

Onamba manufactures custom wire harnesses, cables, and interconnect solutions for home appliances, automotive systems, industrial machinery, and renewable energy installations. It also sells harness assembly machines via its subsidiary Union Machinery.

While this is a low-margin, nearly commoditized business, Onamba has managed to hold its ground over many decades through technical know-how, vertical integration, and strong customer relationships in specific niche segments like home appliance wiring in Japan.

While this is a low-margin, semi-commoditized industry, Onamba has carved out a defensible position in selected niches, and its global low-cost manufacturing base (Vietnam, Indonesia, Mexico, etc.) provides some margin protection.

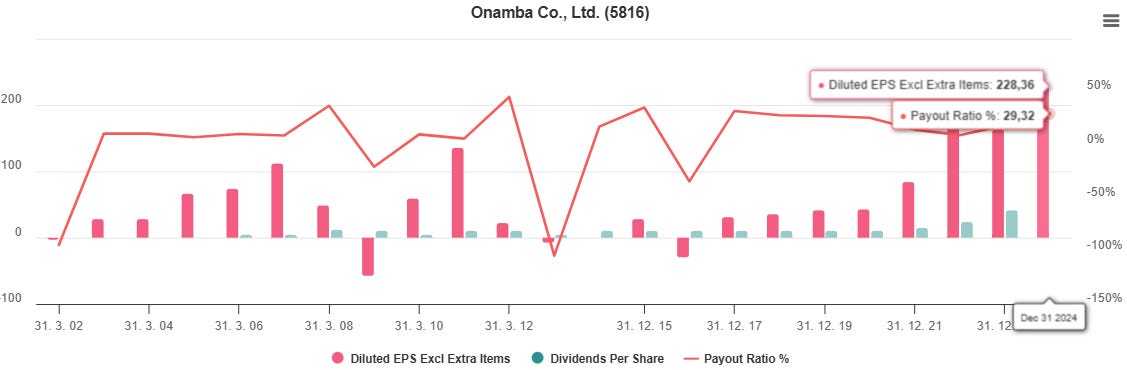

The company's financials are exposed to macroeconomic cycles—particularly in automotive and industrial capital spending—which can lead to fluctuations in earnings. However, due to its diversified end markets and geographic footprint, Onamba's cyclicality is moderate rather than extreme. With net margins in the 4–6% range and ROE recently rising to 9–10% (helped by one-offs), the company has proven capable of generating solid returns even with moderate topline growth over the business cycle.

Shareholder-Friendly Management, TSE Reform Compliance

Onamba has been quick to respond to the TSE reforms.

Their goal is to grow ROE to 10% by investing some of their cash hoard. While returns on invested capital are uncertain, nearly anything should make a better return than keeping a hoard of cash on the balance sheet. Of course, the more they return to shareholders, the better. With that in mind, they plan to grow the dividend to a base ¥70/share (7.4% yield) in 2026 by increasing the payout ratio above 30%.

They also demonstrated their willingness to sell unproductive assets when they sold their old Osaka headquarters building and adjacent land and paid a special dividend from the proceedings.

IR materials clearly acknowledge undervaluation, but no buyback has been announced yet. With ¥7.3B in cash and a P/B of 0.45, this could be the highest ROE move with the lowest risk and remains a key catalyst.

Valuation

“All intelligent investing is value investing. Acquiring more than you are paying for.” – Charlie Munger

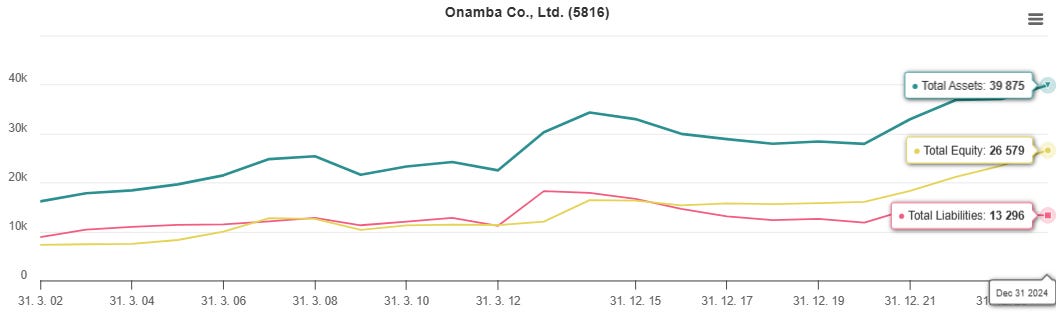

Onamba’s book value per share is ¥2,144, and it trades at just 0.45x that amount. Its cash position of ~¥7.3 billion represents about 60% of its market cap, providing a strong buffer and a clear sign of overcapitalization.

The Cross-Shareholdings still account for ¥1.8B, representing over 15% of the market cap. Most of these represent shares in suppliers or sales destinations and are treated as strategic holdings.

The company owns several properties carried on the balance sheet at historical cost. For example, it sold its former Osaka headquarters and adjacent land, generating approximately ¥1.7B in pre-tax gains. Japanese accounting standards generally favor historical cost accounting, and revaluations are rare. Notably, Onamba still holds property in San Diego that was purchased back in 1986, which remains on the books at its original acquisition cost. The actual market value of such long-held properties could be significantly higher. Overall, I went through several of their land assets and believe there are at least ¥2B of unrealized gains.

The math is compelling. Onamba’s market cap is more than covered by its net current assets. The operating business, which is profitable and shareholder-friendly, comes essentially for free. That kind of downside protection is why I invest—and it leaves plenty of upside if the business delivers on its ROE targets or unlocks further value through buybacks or asset sales.

If Onamba achieves its 2026 target of ~¥2.5B net profit, EPS will exceed ¥200, implying a forward PE under 5x. Combined with the increasing payout ratio (goal: 70¥ DPS in 2026), this represents a path to both capital gains and income growth.

Risk First: The Value Investing Lens

“Being a value investor means you look at the downside before looking at the upside.” – Li Lu

There are two types of risk in investing: volatility and permanent loss of capital. Volatility is noise—it’s something we accept, ignore, or even embrace. But the real risk is losing your capital for good. With Onamba, that scenario seems unlikely. This is a profitable business with a rock-solid balance sheet, trading below net current assets. Even in the worst-case scenario, liquidation value covers your investment. It’s not bulletproof, but the margin of safety is substantial.

That said, investors should understand that Onamba’s earnings are exposed to both input cost and demand-side cyclicality. The company uses a significant amount of copper, a commodity with volatile pricing that can impact gross margins. On the demand side, its key markets—automotive, industrial machinery, and home appliances—are all cyclical in nature, tied to broader capex and consumer spending trends. While geographic and end-market diversification helps smooth earnings, these cyclical pressures can still drive meaningful variability in year-to-year performance.

Why Buy Now? And Why a Basket?

“The stock market is a device for transferring money from the impatient to the patient.” – Warren Buffett

Onamba is not a high-quality compounder or a rapid grower. It’s a stable, undervalued, overcapitalized company that might unlock value. But patience is critical. Sitting on a low-multiple, low-moat stock can be uncomfortable when there’s no immediate catalyst.

That’s why I don’t make concentrated bets on these names. Instead, I build a basket of similarly cheap, asset-rich Japanese companies. I’m not betting on any single catalyst playing out—I'm betting that, over time, a few will and that small wins across the basket will compound nicely.

I’m publishing at least one new Japanese deep-value pitch each week. A full comparison table is coming soon to help track valuations, catalysts, and progress. Subscribe to follow along

.