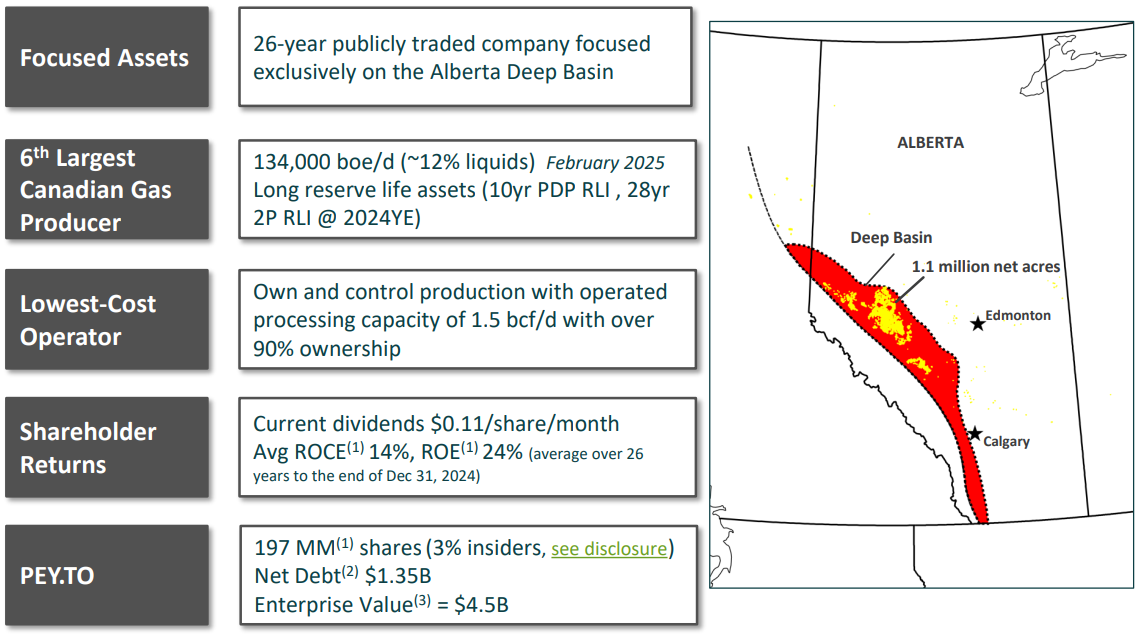

Peyto Exploration & Development ($PEY.TO) has built itself into one of the safest, lowest-cost natural gas producers in Canada. The company’s disciplined approach to cost control, hedging, and market diversification has put it in a position to generate enormous free cash flow (FCF) at current pricing levels, with a high chance of doubling its already high dividend yield of 8% very soon.

I’ll be running a detailed projection and scenario analysis to quantify Peyto’s FCF potential, but first, let’s go through why Peyto stands out as a top-tier, low-risk gas investment.

This is not an introductory article into Peyto, as I have covered the company here and here in the past. I’ll still give you a quick review of 2024, but the focus of this article is on the detailed 2030 PROJECTION, as that’s where the opportunity lies.

2024 was Strong, 2025 Another Level

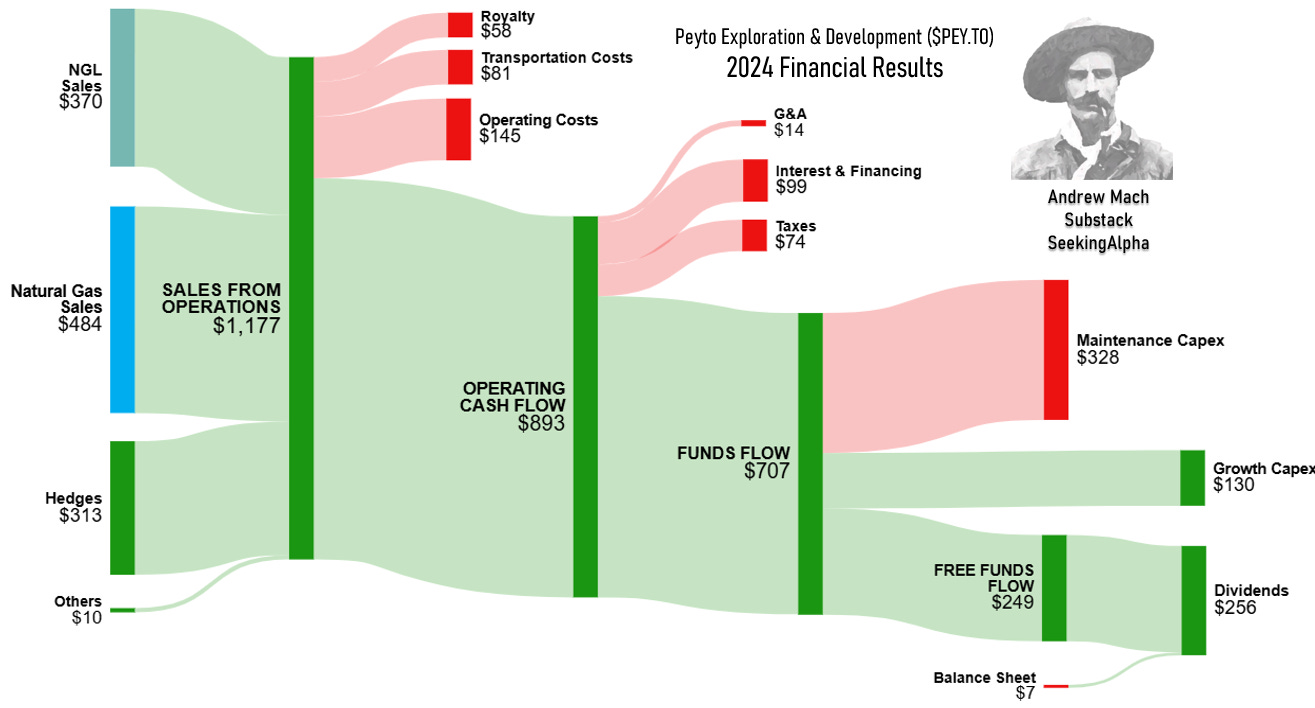

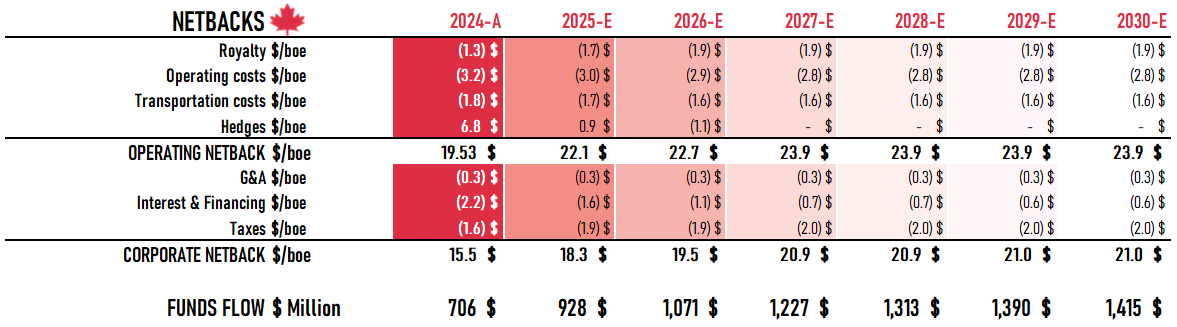

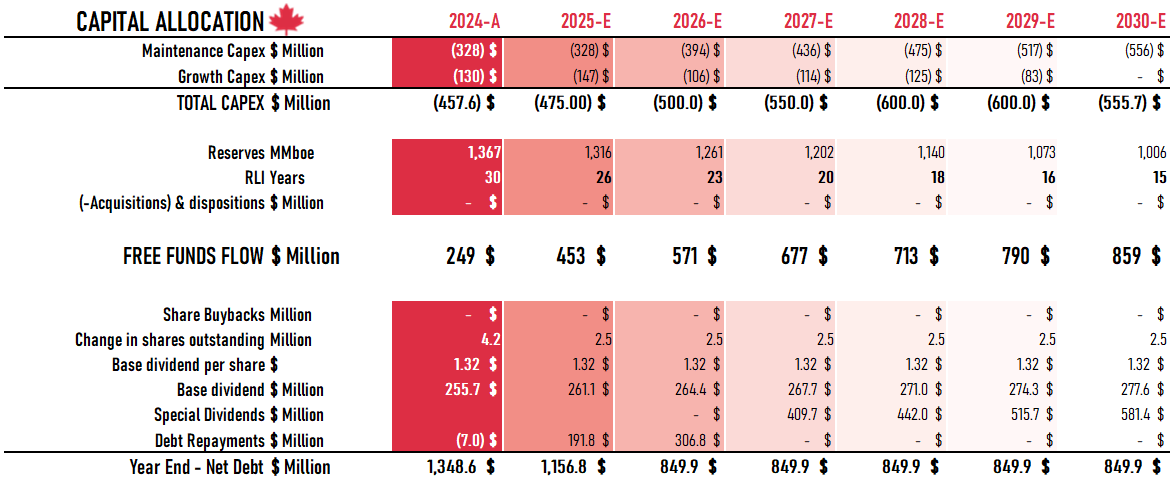

Despite 2024 being a weak year for natural gas prices, with Henry Hub averaging US$2.27, Peyto delivered record production, strong netbacks, and a solid balance sheet, all while maintaining one of the best capital efficiencies in the industry. I could talk a lot about financials, but I believe the graph below gives you more than a thousand words.

👉 Do you enjoy these graphs? Subscribe for free to get the next one straight to your inbox!

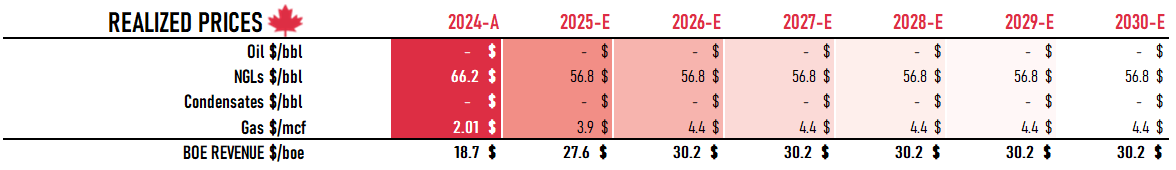

We can see that the hedges stole the show again. The average realized gas price (excluding hedging) was only C$2.01/mcf. A price of 65% compared to Henry Hub, which is even slightly below Peyto’s 5-year average of 68% - a number that I am using in my 2030 projection. The hedging gain of C$1.14/mcf was the only reason why Peyto could still cover its rich monthly dividend of C$0.11 while still investing in the development of the acquired Repsol lands.

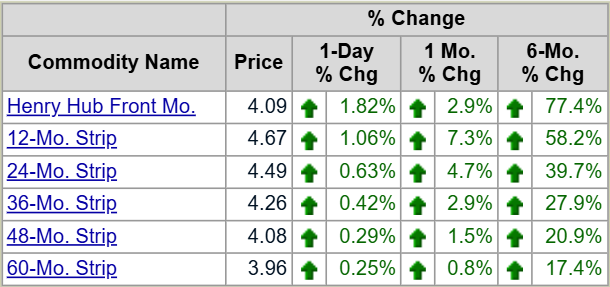

Peyto has secured great prices for 2025 and 2026, but observing the current strip pricing for Henry Hub, they might not need those hedges to deliver extraordinary results.

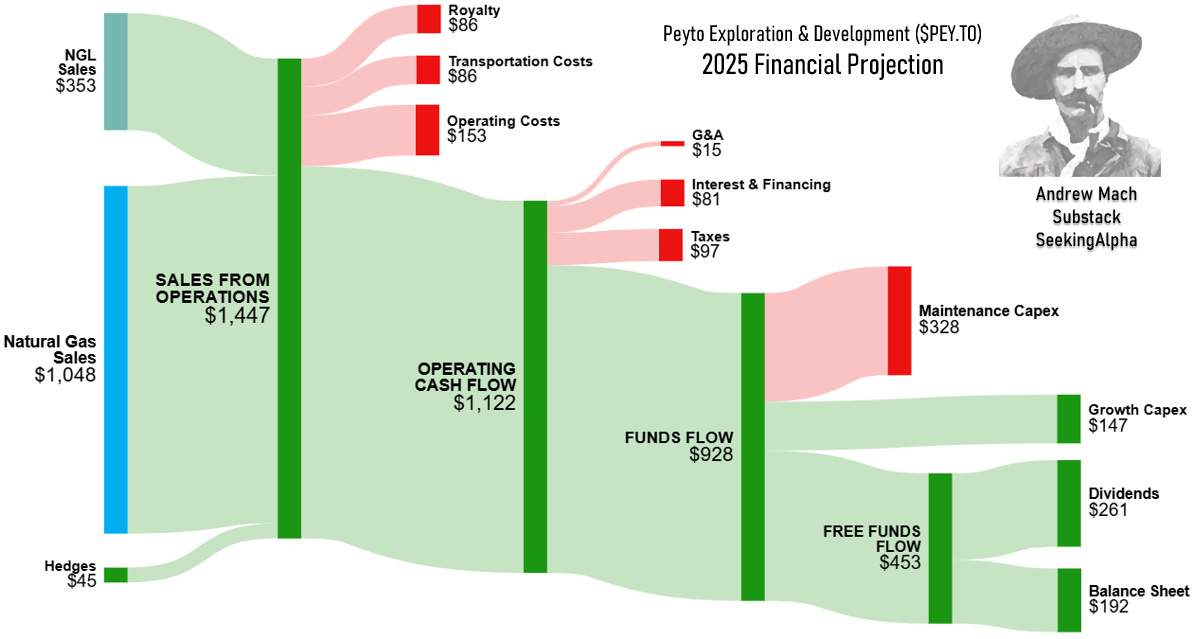

With a benchmark price of US$4 for the Henry Hub, I expect Peyto to make over C$900 million in Funds Flow next year, with over 30% growth YoY, despite the low utilization of the hedges. This will allow Peyto to easily cover its base 8% dividend while quickly paying down its debt and still investing for ~9% output growth.

Building the 2030 Projection Step-by-Step

Creating a long-term financial projection for a natural gas producer like Peyto involves breaking down its key business drivers. These include production growth, realized prices, cost structure, and capital allocation decisions. In this section, I’ll provide a structured discussion on each of these factors, giving you a clear rationale for the assumptions used in the 2030 model.

Note: The Base Case is built close to strip prices at 2025 HH of $4/mmBtu, 2026 forward HH $4.5/mmBtu, WTI $65/bbl. I will provide different pricing scenarios after the base case.

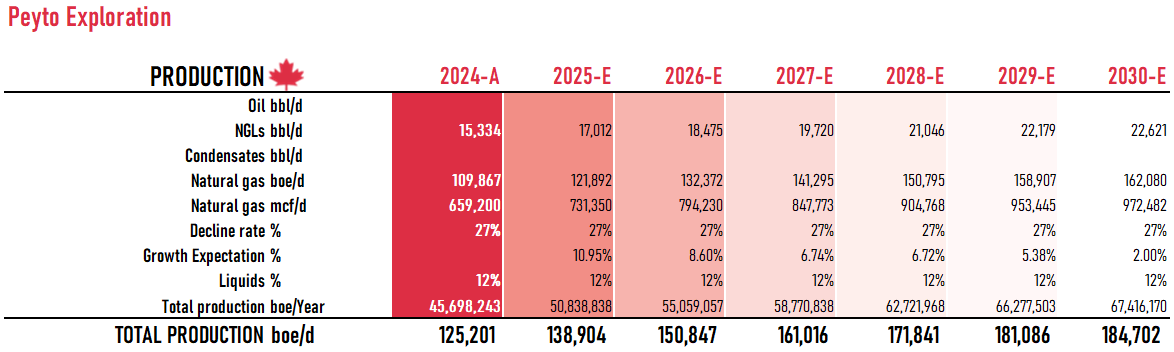

1. Production Growth – Controlled, Efficient Expansion

Production growth isn’t something you simply set as a target - it’s a direct result of how much capital is invested and how efficiently it is deployed. In 2024, Peyto achieved an impressive capital efficiency of C$9,700 per flowing boe. For 2025-2027, they are guiding for C$10,500 per flowing boe with approximately C$475M in Capex.

The biggest expense for the company is offsetting natural declines, which Peyto estimates at 27% annually. The math is simple:

C$475M in Capex ÷ C$10,500 per flowing boe = ~45,000 boe/d added

45,000 boe/d – 27% base decline (~34,000 boe/d lost) = ~11% net production growth

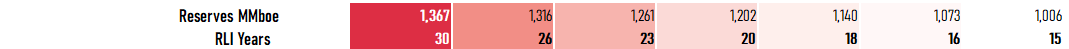

Growth should also be sustainable. In Peyto’s case, the company has enough reserves to maintain current production for 30 years. Even if they increase output significantly by 2030, they will still have 15+ years of reserves, ensuring long-term viability.

2. Realized Prices – Locking in Profits, Reducing Volatility

Having high production means nothing if you can’t sell it at good prices. Peyto ensures profitability by diversifying its gas sales beyond AECO, securing premium pricing through Henry Hub, Dawn, and other U.S. hubs.

In 2024, hedging saved the company, adding C$1.14/mcf in realized price uplift, pushing their average realized price above C$4.28/mcf—while AECO averaged just C$1.4/mcf. Peyto continues to capitalize on this pricing strategy:

480 MMcf/d hedged for 2025 at over C$4/mcf

366 MMcf/d hedged for 2026 at similar levels

Over C$850M in secured revenue for 2025 alone

For modeling purposes, I use Peyto’s 5-year average realized price of 68% of Henry Hub's price for the unhedged part of their production.

3. Cost Structure – Keeping Every Dollar Under Control

Peyto’s business thrives on efficiency and cost control, ensuring it remains profitable at almost any gas price. Let’s break it down:

Operating Costs: Currently C$0.50/Mcfe ($3/boe), among the lowest in the industry.

Transportation Costs: Stable at C$0.27/Mcfe.

Royalty Rates: ~7% of revenue but expected to rise toward 10% as prices improve.

Interest Costs: Currently at 6.8% weighted average, but should decline as the highest interest rate debt is paid down, and with the company’s growth might come higher credit rating.

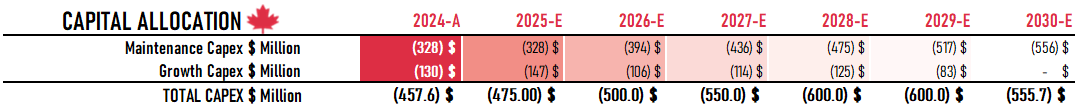

4. Capital Allocation – Where the Money Goes

Once free cash flow is generated, it has to be allocated efficiently between growth, debt reduction, and shareholder returns.

Growth CAPEX - Maintaining 6-7% production growth will require growing Capex, as the maintenance Capex grows with the higher production output.

Peyto currently holds C$1.35B in net debt but aims to reduce it. With the higher gas prices, the opportunity cost is to high. I believe that after reaching C$1B in net debt, Peyto will maintain that level for tax efficiency. Paying down some debt will also reduce interest costs, further improving netbacks.

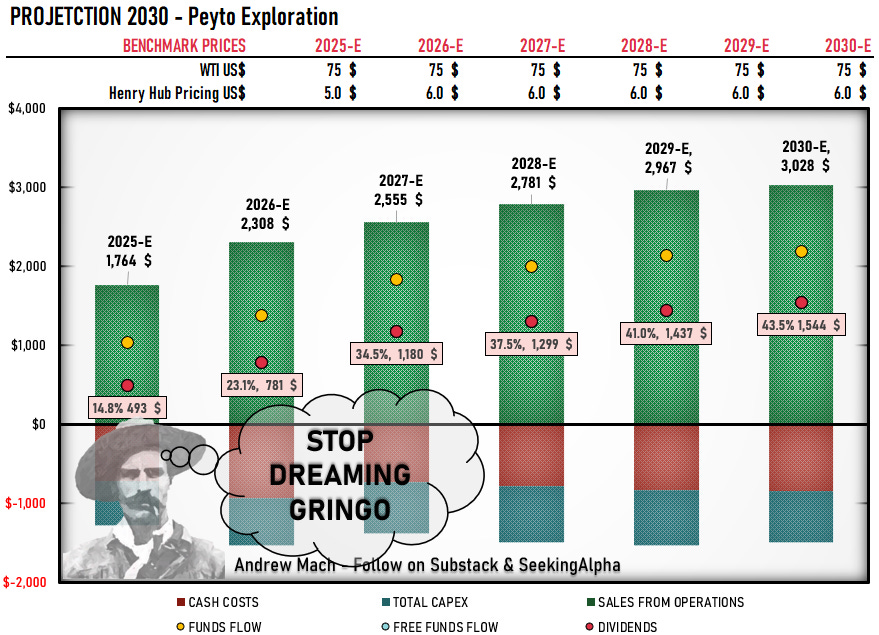

Shareholder Return - The bottom line. That’s why we do projections: to find how much is left for us. Let’s see it on the visualized projection below.

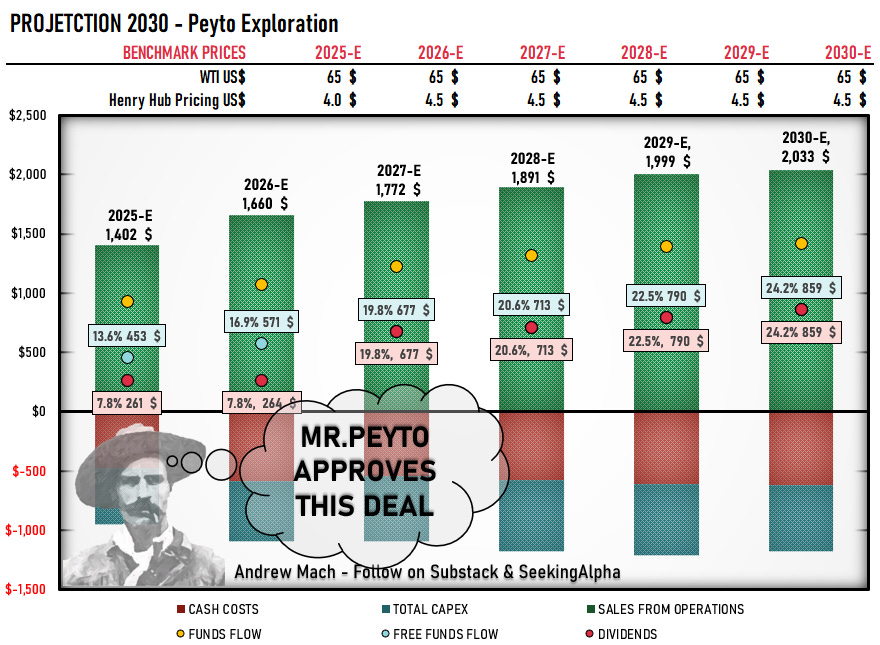

This is the visualization of my projection. The figure in the bottom left corner is Ebenezer 'Wild Bill' Peyto, observing just how crazy Peyto's valuation is while smoking his cigar.

When shareholders saw a 102% payout ratio in 2024, many were afraid about the stability of the 8% dividend. With the hedges in place and much higher gas prices, Peyto has room for significant growth in the coming years. This year alone, Peyto will be deciding what to do with C$453M, (13.6% yield) above the growth Capex. While I believe that 2025 and 2026 will be both years of focus on debt reduction, 2027 is a year where Peyto could give us a 20% yield, mostly in the form of dividends.

👉 "Like this deep dive? Get my next report straight to your inbox—subscribe for free."

Managing Risk – Understanding the Key Variables

Before diving into risks, it's important to acknowledge that everything in my projection is subject to change. The figures provided by management are based on current assumptions and market conditions, but in reality, there are countless moving parts that interact with each other. Factors such as commodity prices, capital allocation efficiency, drilling results, and infrastructure constraints all play a role in shaping Peyto’s future. Any miscalculations or unexpected developments could materially impact long-term growth and cash flow projections.

While Peyto has established itself as one of the lowest-cost and most disciplined natural gas producers, the energy sector is inherently cyclical, and risks must be carefully considered. The most significant ones include production & execution risks, regulatory & taxation risks, interest rates & debt management.

Ultimately, the largest risk remains the volatility of natural gas prices. This is why I create different pricing scenarios in my projections—to account for both bullish and bearish environments and ensure a clear understanding of Peyto’s financial resilience across multiple market conditions.

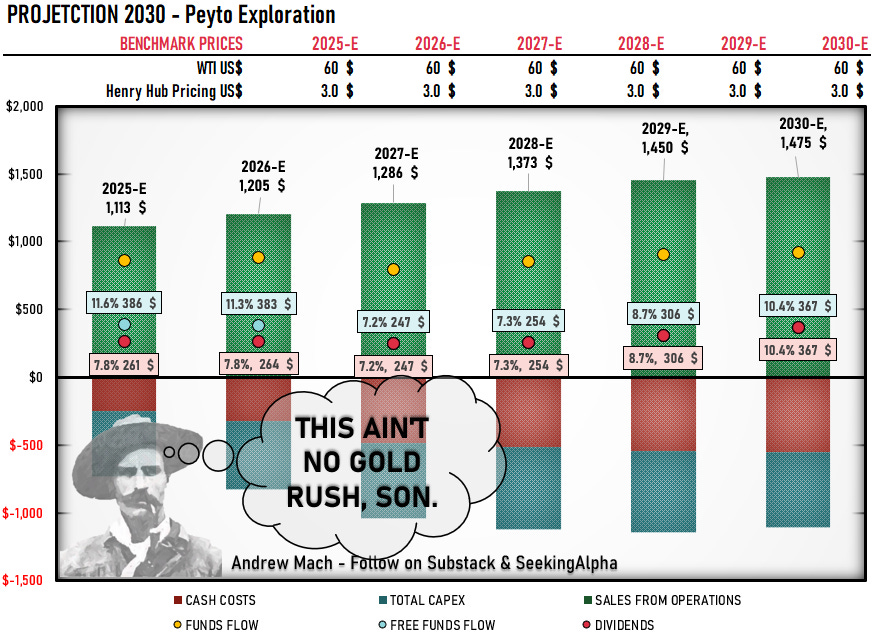

The Bear Case

In the bear case of Henry Hub prices falling back below US$3/mmBtu, Peyto’s hedges would help the company to keep its double-digit Free Funds Flow yield. This is still while spending for growth, so the dividend is still safe, as the first place for cutting would be the growth Capex.

As Mr.Peyto says, this ain’t no gold rush, but he approves anyway.

The Bull Case

It’s not even part of my thesis, but such gas pricing is nothing unimaginable. I adjusted my assumptions for no more debt repayments, boosted the growth Capex spending by 10%, and set up a 100% payout ratio.

Final Thoughts – Peyto is Now in the Fund Portfolio

Peyto has built an enviable position in the natural gas sector, combining low-cost operations, strategic hedging, and disciplined capital allocation. The company has the ability to generate significant shareholder returns over the next five years, with a potential 20%+ free cash flow yield by 2027.

While there are risks, Peyto’s structural advantages and management execution mitigate much of the downside. The company is well-positioned to weather commodity cycles while still growing production, reducing debt, and increasing shareholder distributions.

Given the compelling valuation and strong free cash flow outlook, I have added Peyto shares to the Fund portfolio, taking advantage of what I see as an amazing risk-reward opportunity in the energy sector.

👉"I’ll be tracking Peyto’s results closely in the coming months. To get the latest updates, sign up below!" It’s FREE.